Gifts That Cost You Nothing Now

You can make a lasting impact

Gifts in a will or by beneficiary designation are two easy ways to fight for the well-being of future generations of children and help transform the future of child health for years to come — and they don’t cost anything now.

Gifts in a Will

Making a legacy gift in your will or trust is one of the easiest and most popular ways to make a lasting impact for SickKids. Once you have provided for your loved ones, we hope you will consider making compassionate, specialized care for children part of your life story through a legacy gift.

A gift in your will is one of the easiest ways to create your legacy for children’s health and offers the following benefits:

NO COST

Costs you nothing now to give in this way.

FLEXIBLE

You can alter your gift or change your mind at any time and for any reason.

LASTING IMPACT

Your gift will create a healthier future and better world for all children.

Four impactful ways to give in your will

Specific gift

Leaves a gift of a stated sum of money to SickKids in your will or living trust.

Residual gift

Contingent gift

You can mix these no-cost ways together. For example, you might consider leaving a specific percentage (such as 50 per cent) of the residual to SickKids contingent upon the survival of your spouse.

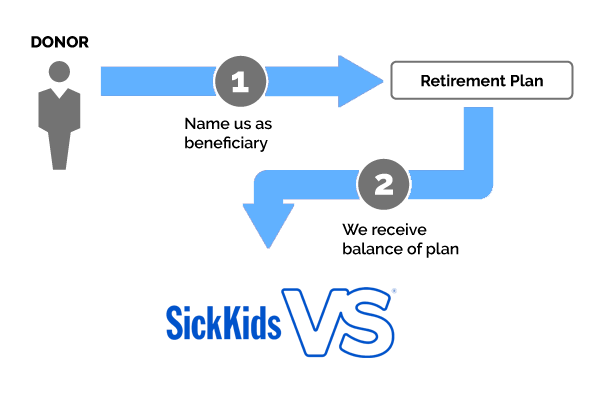

Gifts by Beneficiary Designation

It’s easy to put your retirement savings plan (RRSP), Tax-Free Savings Accounts (TFSA), life insurance, registered retirement income funds (RRIF), mutual funds, or other financial accounts to use in extending our excellent and compassionate standards of care to more children around the world to foster the lifelong well-being of children — and it costs you nothing now.

By naming SickKids as a beneficiary of these assets, you can power our mission for years to come and establish your personal legacy of powering child health research, learning and care.

Reduce or eliminate taxes

Reduce or avoid probate fees

No cost to you now to give

Create your legacy of groundbreaking treatments and cures for childhood conditions

To name SickKids as a beneficiary of an asset, contact the custodian of that asset to see whether a change of beneficiary form must be completed.

How to Change a Beneficiary Designation

Login to your account or request a Change of Beneficiary Form from your custodian (the business holding your money or assets).

Types of Gifts

A gift of retirement funds

You can simply name SickKids Foundation as a beneficiary of registered retirement plans to make a lasting impact in the fight for children’s health for future generations.

You may reduce your taxes by receiving a tax receipt for the value and avoiding probate fees by removing the assets from your estate.

A gift of funds remaining in your bank accounts, investment accounts or guaranteed investment certificates (GIC)

This is one of the easiest gifts to give and one of the most useful in accomplishing your philanthropic goals. The next time you visit your bank, you can name The Hospital for Sick Children Foundation (Charitable Business Number: 108084419RR0001) as the beneficiary of a checking or savings bank account, an investment account, or guaranteed investment certficate. When you do, you’ll take a powerful step toward transforming the way we do medicine, to make a bigger impact on paediatric patients for generations to come.

Donor-Advised Fund (DAF) residuals

What remains in a donor-advised fund is governed by the contract you completed when you created your fund. When you name SickKids as a “successor” of your account or a portion of your account value, you enable lifesaving cures and excellent care for kids.

Savings bonds

If you have bonds that have stopped earning interest and you plan to redeem them, you might owe income tax on the appreciation. That could result in your heirs receiving only a fraction of the value of the bonds in which you invested. Since SickKids is a tax-exempt institution, naming us as a beneficiary means that 100 per cent of your gift will go toward fighting for the health and well-being of children.

Our Team is Here to Help

Our experienced team is here to help you…

- Learn about special projects that align with your interests.

- Structure a donation that maximizes benefits for you and your loved ones.

- Stay up to date on how your gift is used.

- And more.

Jessica John

Director, Leadership & Legacy Giving

Eva Avramis

Associate Director, Leadership & Legacy Giving

William Yu

Associate Director, Leadership & Legacy Giving

Sydney Smith

Manager, Leadership & Legacy Giving

Genevieve Heijmans

Associate, Leadership & Legacy Giving